RESEARCH:

Dynamic Earnings Call Strategies

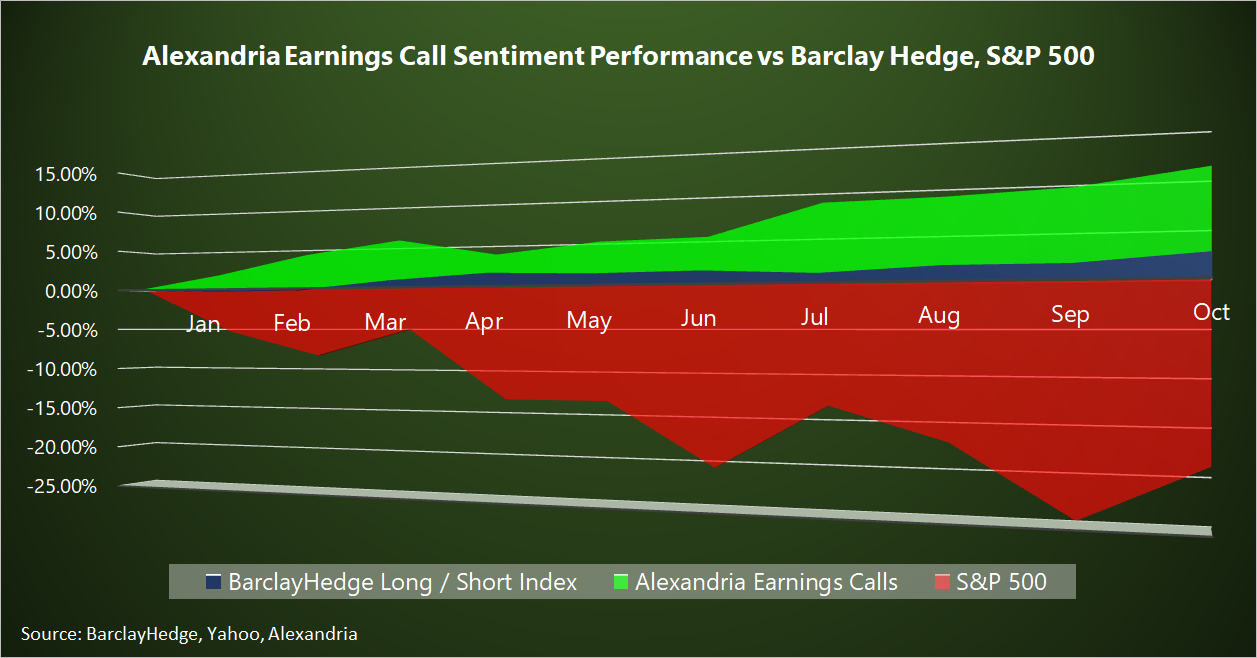

The beginning of 2022 saw the worst cumulative performance for the S&P 500 in over a decade. This research paper shows how to implement a Dynamic Earnings Call Strategy that has outperformed the benchmark by +30% YTD annualized. Paper highlights include:

- Construct dynamic long-short strategy based on earnings call sentiment to account for market rotation and high volatility

- Build detailed thematic company outlooks beyond qualitatively listening to calls or quantitatively analyzing numbers in a report

- Strategy YTD return +11.1% (+29.9% over the S&P 500) and long-term Alpha illustrated below

- Contact us to replicate these results within your own investment strategy

Request the full research below or here

* Earnings Calls sentiment derived FactSet XML Transcripts Database (www.factset.com)