Capture Alpha in Volatile Markets with News Sentiment

- Volatility has returned with a vengeance in 2022 with the S&P 500 off to its worst start in 50 years, down over 20% year-to-date through June 30, 2022

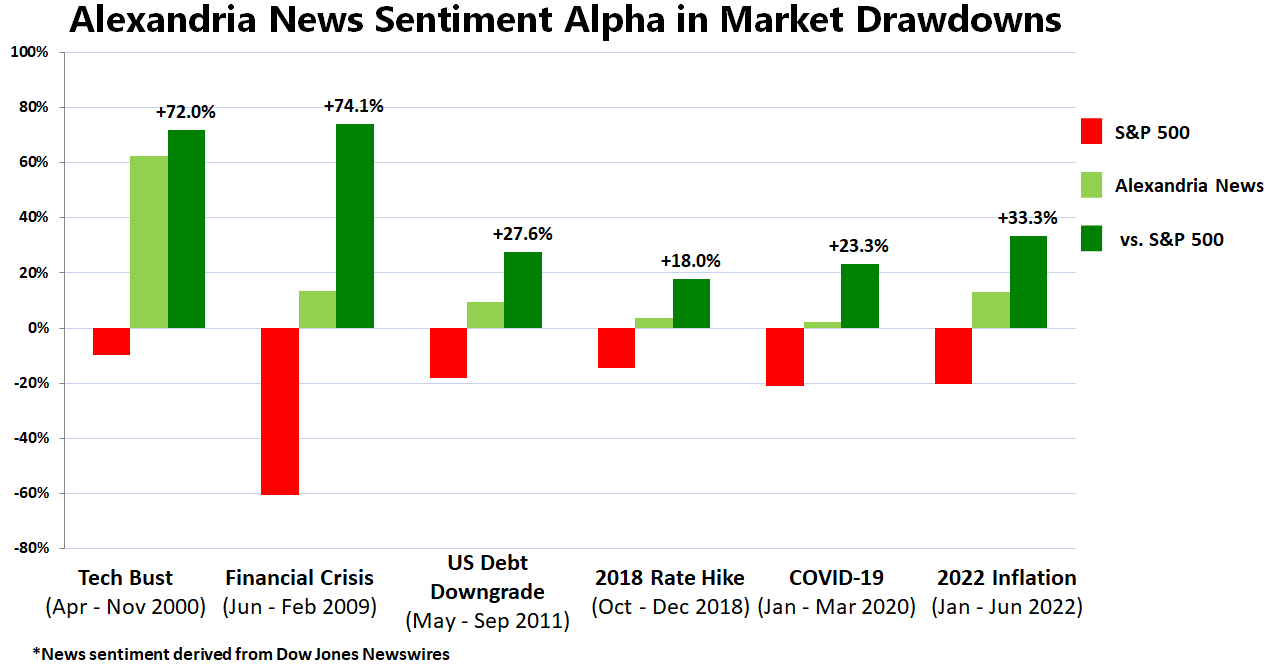

- Sentiment can contribute significant Alpha during times of market disruption (see chart below including Alpha generation in Tech Bust (+72%); Financial Crisis (+74.1%); COVID-19 (+23.3%); Inflation / Geopolitical 2022 (+33.3%)

- Replicate these results yourself: For more information on this study and to replicate these results within your own process, please contact Alexandria here.

Volatility has returned with a vengeance in 2022, with markets gyrating wildly on concerns around rising interest rates, a hawkish Fed, continued supply chain challenges, and the war in Ukraine. The S&P 500 got off to its worst start in over 50 years, dropping 20% YTD through 6/30/22.

Investment managers who can successfully navigate choppy markets can generate significant Alpha for their clients. Alexandria’s analysis of global news can be a key contributor to outperformance. We analyze millions of articles, capturing deep thematic sentiment predictive of stock price movements. Out of sample research shows Alexandria data is a significant Alpha factor: (“Historical Outperformance section below”).

With heightened market volatility the importance of news analytics is further accentuated. As examples, below are some of the most significant market disruptions over the last several years, along with the relative performance of using Alexandria’s news sentiment vs. the S&P 500.

Historical Performance

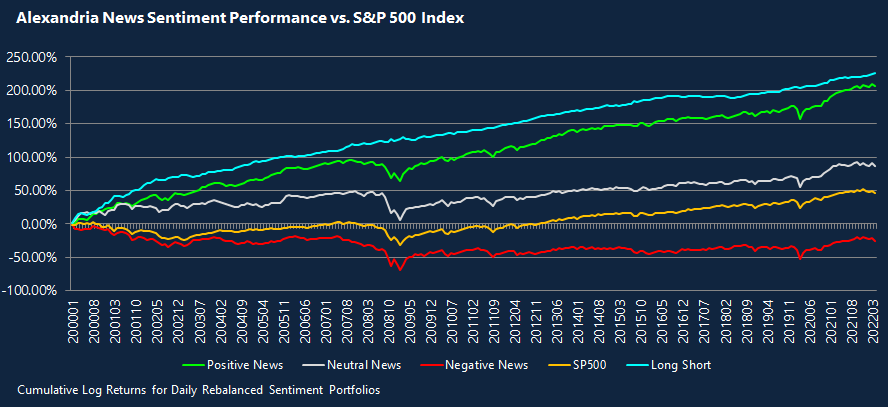

Trained by financial experts to read like a seasoned investment professional, Alexandria’s AI has a deep understanding of language and context, resulting in highly accurate classification. Our technology reads full text in milliseconds, accurately identifying sentiment, themes, and more, and showing full statistics that users can fit to their specific investment strategy. As shown below, the companies we identify with negative sentiment underperform the S&P 500, while those with positive sentiment significantly outperform.

Replicate This Study Yourself

For more information on this study and to replicate these results within your own investment process contact Alexandria here.